Personal Investment Advice

A friend recently asked me for advice on how to get started with investing their money. Here is a quick writeup I shared with him.

Intro

A basic belief I have is the theory put out by A Random Walk Down Wall Street: one cannot consistently outperform market averages. Therefore, any investments you make should seek to minimize cost. In addition, any investments you make should be done with tax efficiency in mind. And, lastly, you will need to consider your age & risk based asset allocation.

Low Cost Investment Vehicles

The most famous (and my favorite) low cost investment vehicles are Index Mutual Funds offered by Vanguard. They can be acquired directly through Vanguard or via ETF in your brokerage of choice. Both options are fine.

Tax Efficiency

HSA

If you have access to HSA, I suggest maxing it out. It is easier than ever to buy things with HSA (e.g. Amazon.com HSA filter) I suspect it will be the 'retirement account of the future'.

401k

Max it out if you have means to do so. At our age, put all the money into the stock market. I prefer a 60% domestic and 40% international ratio. I periodically rebalance to it to match that. I choose whichever index funds my 401k provider offer that have the lowest expense ratio.

Roth IRA

If you qualify, max this out as well. Post taxed income can be contributed and it grows tax free until retirement. If you earn up to $122,000 you qualify for a full contribution, otherwise $122,000–$137,000 offers partial contribution.

Backdoor Roth IRA

It seems a bit strange, but this is a great investment vehicle that if you have excess funds you should take advantage of. Schwab and Vanguard both have good support for it to make it very easy to do.

Beware: if you have any traditional IRAs (perhaps rolled over from an old employer 401k) you may not want to take this strategy. As soon as you do the rollover, you have to pay taxes on any gains across all your Traditional IRAs.

Mega Backdoor Roth IRA

Some employers support in-plan Roth IRA conversions. This is harder to set up than regular Backdoor Roth IRA but you can put more into this. Again, same tax implications apply if you have any Traditional IRAs.

UTMA / UGMA

If you have children, Vanguard / Schwab make it easy to open UTMA accounts on their behalf. Through these accounts, $1100 income / capital gains per year is tax free and next $1100 is in a low tax bracket.

529

If you have children, 529 can be a good vehicle to save on taxes. New York's Plan offers Vanguard funds which are efficient. Note: once money is transferred via 529 it should be used for educational purposes.

Asset Allocation

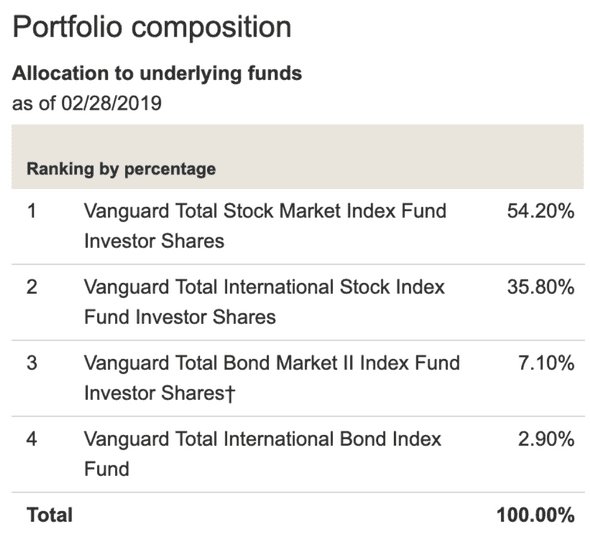

The closer you are to retirement (or to needing your funds) the more of your money should be in lower risk investments i.e. Bonds. One way to achieve this is to buy Target Date Funds e.g. Vanguard Target Retirement 2050 Fund. Its allocation is:

Meaning it’s opinion is someone our age should have 90% in stocks and 10% in bonds. A good discussion on Target Date Funds can be found here. I think it is a good option if you want to be completely hands off.

Personally, I prefer to buy and sell the underlying Index Funds (and other index funds) mainly for two reasons:

1. Tax Advantage

A wider variety / diversification of investments allows for more variety in gains / losses. Which means year-to-year you can more easily offset gains of one investment against the losses of a different investment.

2. Expense Ratios

I generally have not seen Target Retirement funds with expense ratios quite as good as holding the underlying funds. While this is not a great apple-to-apples comparison the Vanguard Target Retirement 2050 Fund has 0.15% expense ratio while Vanguard Total Stock Market Admiral has 0.04%. That small difference adds up over the years.

Summary

Given all that, here are a quick few steps to get investments in order:

- Ensure 401k is invested properly in stock index funds.

- Evaluate tax advantaged vehicles (HSA, Roth IRA).

- Consider tax advantaged children accounts (UTMA, 529).

- After ensure you have enough cash available, move the rest (in a time averaged way) into low cost Index Funds (or their ETF counterparts). Allocation is up to you and your risk profile, but here is a potential allocation described below:

60% Vanguard Total Stock Market

30% Vanguard Total International Stock Market

10% Vanguard Short-Term Bond Index Fund

For more reading, see also my year end summary checklist.